Turn Incidents Into Resilience X-rays: Using Network Outages as Complexity Audits

After a major outage, we conduct PIRs (Post Incident Reviews). If we find something, we usually add controls. But when you think about it, that’s

In telcos, everyone’s working toward the same goal right?

Well, we all know that’s not exactly right. Speak to the CEO, the CFO, the CTO, the COO, the CMO, etc, and you could end up thinking they’re talking about different companies (a bit like the story of the six blind men and an elephant).

And here’s the twist: none of them are wrong.

Last week Sebastian Barros posted a fascinating article “Confessions of a Telco Executive Week #1,” from an anonymous CFO’s perspective. The subtitle was, “People Don’t Get Telcos’ Financials.”

Please go to the link and have a read, especially if you have a more tech-centric perspective. It’s well worth a read!!

.

Here’s how I’d break down the key points from the article:

1. Telco is not, and hasn’t been for years, a growth sector

The CFO is rejecting the “flat growth = decline” narrative by reframing telco as infrastructure, not tech

Low single-digit revenue growth isn’t alarming when your investment thesis is built on durability of cash flows rather than market expansion

This is the same mindset that underpins utilities, toll roads, and airports

2. Net profit is a red herring in telecom accounting

Depreciation from legacy infrastructure and spectrum amortisation massively distort the income statement

These non-cash charges erode net profit but don’t touch actual liquidity

This is why free cash flow is the real health metric, and why many “ex-growth” telcos still return billions in dividends

3. The investor base is fundamentally different from tech

Pension funds, sovereign wealth funds, and infrastructure investors prioritise predictable yields over capital appreciation

They know ROIC often sits below WACC – the play is income security, not multiple expansion

In other words, the financial “underperformance” some analysts decry is actually the model working as intended

4. Debt structure is misunderstood

Telco leverage is long-term, asset-backed, and tied to national strategic assets like fibre and spectrum

This isn’t the same as venture leverage or consumer debt – it’s more like a 30-year infrastructure bond

As long as regulation keeps Tier-1 operators from collapsing, the debt profile is designed for resilience

5. The “must change or die” narrative is overplayed

Yes, value migrates “up the stack” to apps and platforms, but the connectivity layer is irreplaceable

You can’t do AI inference at the edge without physical edge sites, power, and backhaul

The CFO is subtly pushing back on the hype cycle while acknowledging operational modernisation is still needed

6. The real telco weakness is storytelling, not solvency

The industry sells continuity and stability – which doesn’t excite equity analysts chasing volatility

But the same “boring” model quietly generates ~$300B in free cash flow annually

The implication: telcos don’t need to promise moonshots to remain essential

.

The thing that got me thinking is that none of this is wrong….

The CFO’s framing matches well-known industry dynamics in mature Western markets (when looking through the lens of traditional services anyway):

Commoditisation: Consumers view connectivity as a utility; competition is largely on price and coverage

Customer saturation: Near-100% penetration in mobile and fixed broadband means no real greenfield growth

Elasticity limits: ARPU uplift via premium services is hard because customers don’t perceive enough extra value

Low NPS: Decades of poor service experiences reflected by low NPS scores across the telco industry might seem to imply that customers would be reluctant to pay more

Heavy fixed-cost base: Spectrum, towers and fibre have enormous sunk costs and long payback horizons

Investor profile: Yield-seeking infrastructure capital is attracted to the stability, not the growth potential (which also incentivises stability hires in senior leadership positions)

In that context, high growth is structurally improbable and the CFO is right to say the financial model is optimised for cash yield, not equity growth.

We could argue that the CFO narratives slip into selective framing such as the following, though we won’t attempt to argue for/against “legitimate structural constraints” vs “excuses for underperformance”:

Framing “boring but safe” as a virtue: This risks becoming a comfort blanket for avoiding hard transformation, service quality improvements, or bold strategic moves

Ignoring opportunity cost: Free cash flow may be strong, but if it’s not being deployed into value-creating adjacencies, then the business risks long-term relevance erosion

.

Instead, here’s where I thought things got really interesting when reading Sebastian’s article. It’s not just the analysts that are misaligned on telco financials.

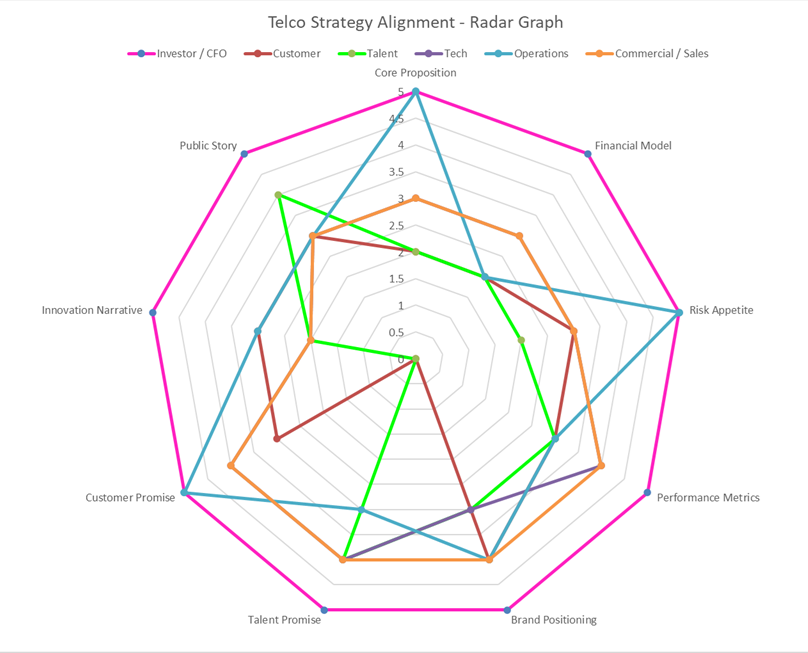

I thought I’d make an attempt at mapping the difference in world views between internal business units – finance, operations and sales / commercial strategy. I then thought I’d also throw a customer and employee (think new graduate) perspective into the mix as well.

Below is the attempt at a heat-map and radar chart of how I’d map the alignment (1 = low, 5 = high) between each functional worldview across the key strategy dimensions. The CFO’s world-view is 5 (green) on each dimension and everyone else’s level of alignment with the CFO perspective is measured on a heat-map (yellow = 4, orange = 3, red = 2 and white = N/A):

And here’s a radar chart of the same:

The most decisive friction points tend to appear in three places:

Core Proposition: Whether the telco is an infrastructure yield machine or a service innovation leader

Risk Appetite: Appetite for piloting emerging technologies versus sticking to proven, amortised assets

Attractiveness to new Talent: Whether innovation is seen as a strategic investment to attract and retain top talent, or an avoidable cost

The misalignment inside telcos isn’t a minor gap in perspective. It’s often a chasm. The CFO’s worldview is built on yield discipline, long-term asset leverage, and avoiding volatility. To the CFO, OSS/BSS investment is a cost centre unless it clearly drives opex reduction, cash conversion, or protects the dividend.

At the other extreme, Customers and Sales / Commercial leaders push for faster launches, richer experiences and digital journeys that delight. They see the same OSS/BSS spend as an enabler of personalisation, omnichannel engagement, and loyalty – all things that rarely hit the CFO’s free cash flow dashboard in the short term.

Talent and Tech leaders bring yet another lens. They want cutting-edge platforms that reduce tech debt and attract scarce engineering skills.

But their appetite for transformation often collides head-on with the Operations mindset, which prizes stability, proven processes and low operational risk (with a bit of tech innovation thrown in for good measure). That operational caution and push for five-nines reliability often finds an ally in Finance, reinforcing the gravitational pull toward incremental change rather than bold re-platforming.

This reminds me of what I refer to as the “Mercedes Conundrum” experienced on a project many years ago. The project needed funding from 3 separate groups. All wanted change. All wanted to invest their budgets…. but only on outcomes that benefitted their KPIs. The problem was that each group’s KPIs were pulling in totally different directions, like the points on the Mercedes Star below.

Needless to say, that project never got off the ground because the 3 groups could never agree on outcomes.

.

Now, being Passionate About OSS, I’m naturally going to bring these disconnects back into how it impacts OSS/BSS.

When these worldviews clash, OSS and BSS programmes become the battleground. CFO-driven governance tends to favour low-risk, iterative upgrades to BSS that protect existing revenue flows or facilitate revenue growth. OSS is often seen as a large cost-centre allocation.

Customers and Commercial leaders, meanwhile, push for new customer-facing (ie BSS) capabilities like personalisation, digital marketplaces, product catalogues, automations / orchestrations, real-time CPQ, etc, all features that demand more ambitious platform changes. Tech and Talent advocates call for cutting-edge technologies / architectures to accelerate delivery and increased automation, while Operations prefers proven, deeply integrated legacy stacks with decades of stability (with a sprinkle of tech innovation).

The result? Many telcos end up with half-modernised OSS/BSS estates, with enough incremental investment to keep the lights on and tick compliance boxes, but not enough to transform service experience, speed to market or significant competitive advantage.

Not that any self-respecting board would listen to me, If I were advising a board after reading Sebastian’s article, I’d frame it like this:

“Yes, we’re an infrastructure yield play for the most part, and that’s fine. But we’re also in a market where some peers create more customer loyalty, higher ARPU, brand value, attract talent and still deliver better returns within the same constraints. Our job is to deliver OSS/BSS that help our telco clients outperform, not just become one of the laggards hiding behind accounting logic.”

.

Just as an aside, I thought it might be worthwhile sharing the chart below that shows just how deeply embedded OSS/BSS are in the telco business model… and how easily we can end up in a Mercedes Conundrum.

After a major outage, we conduct PIRs (Post Incident Reviews). If we find something, we usually add controls. But when you think about it, that’s

When you’re planning your next-generation OSS/BSS roadmap, what’s guiding your decisions? Are you looking for and/or researching features that have never been seen before? Are

According to Russ Hill, IBM had 27 top priorities in the 1990s, and only 3 of them aligned. Telcos today aren’t far off. The cost?

You’re in the business of OSS sales (we’re all in the business of OSS sales if we want to work on an OSS project). Your