Turn Incidents Into Resilience X-rays: Using Network Outages as Complexity Audits

After a major outage, we conduct PIRs (Post Incident Reviews). If we find something, we usually add controls. But when you think about it, that’s

When we’re passionate about OSS and we discuss OSS/BSS transformation, the context is almost always centred around the technology.

But if technology was the real barrier, most telcos would already be running the sleek digital operations of their dreams by now.

As we found in the previous article about telco world views, the real drag on transformation isn’t technology at all. It’s misaligned perspectives and objectives across the many different people required to approve, fund and deliver these projects.

If we take a fundamentally tech-centric perspective:

The buyers (carriers) desperately need better tools to transform their operations.

The sellers (vendors) already have better tools, which they desperately want to sell.

However, the delay in getting an OSS transformation project started boils down to what we refer to as the Buyer – Seller Chasm. Misalignment in world views is one of the major contributors to the chasm, along with trust, risk, skill-gaps and other factors.

In today’s article, we’ll dive into how opposing world-views impact the size of the OSS transformation chasm and what can be done to reduce it. We’ll provide you with 3 tools that help with improving alignment. This includes a persuasion checklist that can be used internally (by project stakeholders) or externally (by vendors / suppliers) to help fast-track an OSS transformation.

.

Telcos are structured around silos that reflect decades of legacy operations: Finance, Technology, Operations, Commercial, Customer.

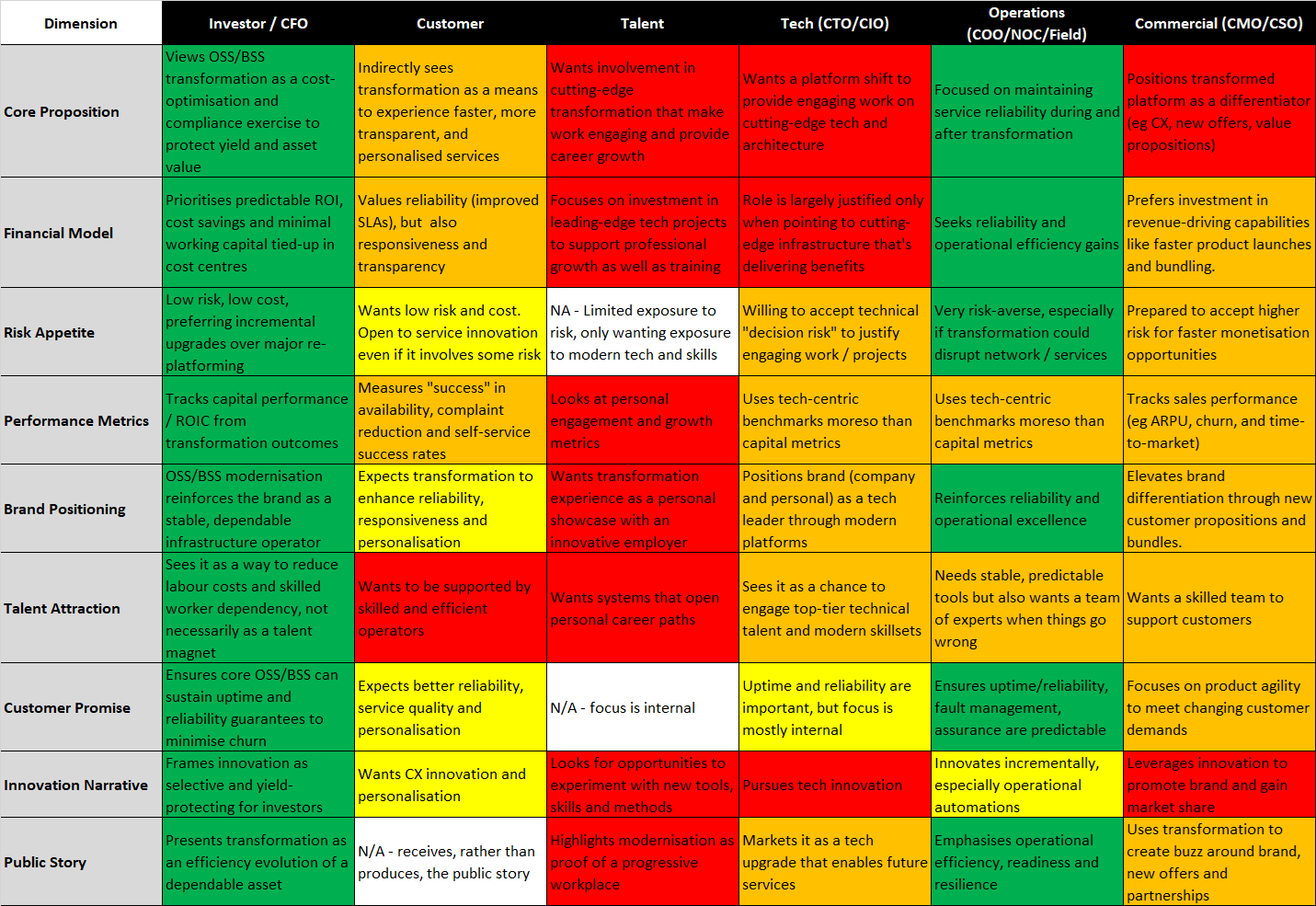

Each views the objectives of the organisation (and OSS/BSS transformation by proxy) through its own lens. Sometimes overlapping, often contradictory, as shown in the world-view heat-map below from the previous article.

As you can see, there’s not a lot of green (ie alignment between the CFO, one of the main decision-makers in an OSS transformation, and other stakeholders)

Finance (CFO) frames transformation in terms of cashflow preservation, depreciation schedules and balance sheet resilience. An OSS/BSS project is judged on how it protects dividends and returns on invested capital (ROIC) whilst negating implementation risk

Technology (CTO/CIO) sees it as a long-term re-platforming exercise, replacing fragile legacy stacks with modular, modern, open architectures that can effectively manage modern networks and services. Their risk lens is avoidance of vendor lock-in, integration failure and technical debt

Operations (COO, NOC, SOC) prioritise stability, uptime and process continuity, not just of the network, but the systems that support them. To Operations teams, “transformation” often feels like disruption disguised as “the promise of progress” (with a healthy dose of skepticism thrown in)

Commercial / Sales (CSO/CMO) seeks agility and “wow factor” in the form of faster time-to-market for new offers, dynamic bundling, personalised engagement, sales / account incentives and more. On the flip-side, they’re frustrated when the stack still takes six months to configure a new tariff plan or when competitors have already released an exciting new offer that is stealing market share (and sales commissions)

Customers are indirect stakeholders that care about outcomes including reliability, fair pricing, good digital experiences, etc. Unfortunately, their voice can only be heard by proxy if someone inside the telco wishes to fight for the customer’s cause

Telcos are in a “war” for Talent to carry the company into future generations when other tech industries look more sexy. These stakeholders judge telcos by how their role and experiences will impact their career growth. Considerations include whether they’ll have the chance to work with modern tools (eg OSS) or if they’re stuck in outdated, monoliths

When you put these perspectives on a map, the misalignment becomes stark. Finance and Operations sit in one corner, defending continuity. Commercial and Customer scream for agility in another. Technology floats somewhere in between, translating vision into platforms but struggling to bridge the cultural gulf.

.

OSS/BSS transformations are uniquely exposed to this misalignment. Unlike a marketing campaign or network rollout, that stays largely within the walls of each operational silo, OSS/BSS cut across every stakeholder group simultaneously, as shown in the diagram below. Billing, assurance, orchestration, inventory, etc – each change ripples through finance systems, operational workflows, user/customer journeys and tech stacks.

If the CFO views OSS/BSS spend as cost containment (blue) but the CMO views it as growth enablement (green), and the COO is not convinced that resilience is improved (red), they’ll quietly resist adoption no matter how well the business case stacks up. This is the Mercedes Conundrum with 3 groups all being pulled towards their own separate KPI objectives with no holistic alignment (no single north star).

As we all know well, this is a challenge worth overcoming, so we’ve attempted to create some tools to improve cohesion.

.

There are structured ways to shift from misalignment to cohesion. The next 3 tools are how we do it, but we’d love to hear your advice on how to do it better.

.

Using the concept of the world-view alignment heat-map chart above, you can determine the level of cohesion between your stakeholders. In turn, this can help to guide your communications / messaging strategy.

Whilst the earlier sample shows alignment to the CFO’s “north star” of a telco more broadly, the example below provides a more OSS-centric alignment heat-map:

.

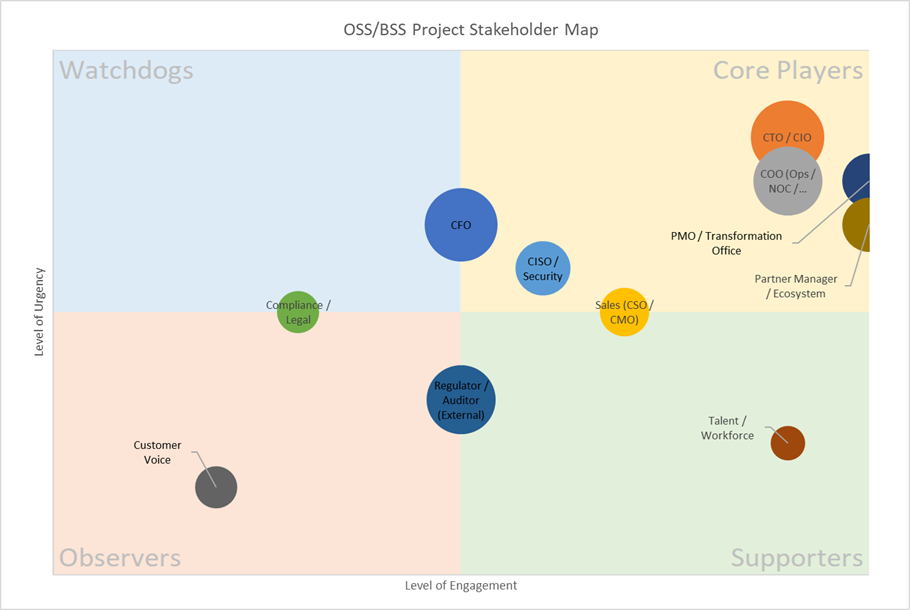

With so many stakeholders involved, it can help to prioritise your stakeholder engagement effort. We’ve created a matrix that scores the following factors for each persona on a scale of 1 (low) to 10 (high):

We’ve shown a sample Stakeholder Matrix in the diagram below (BTW. If you’d like a copy of our template so that you can insert your own stakeholders into the chart, drop us a note).

The 2×2 matrix can be summarised as follows:

Core Players (High Urgency, High Engagement)

Require daily or weekly touchpoints. They shape the scope, funding and delivery of the project

Watchdogs (High Urgency, Low Engagement)

Don’t “build” the project but can block progress quickly if not satisfied

Supporters (Low Urgency, High Engagement)

Valuable contributors but don’t require constant stakeholder management as they don’t have significant influence

Observers (Low Urgency, Low Engagement)

Are needed to be kept in the loop, but don’t consume energy beyond milestone communications (eg newsletters or status update reports)

The major shortfall of this approach is that it doesn’t adequately consider relationships and influence paths between stakeholders (valuable when internal politics matter).

.

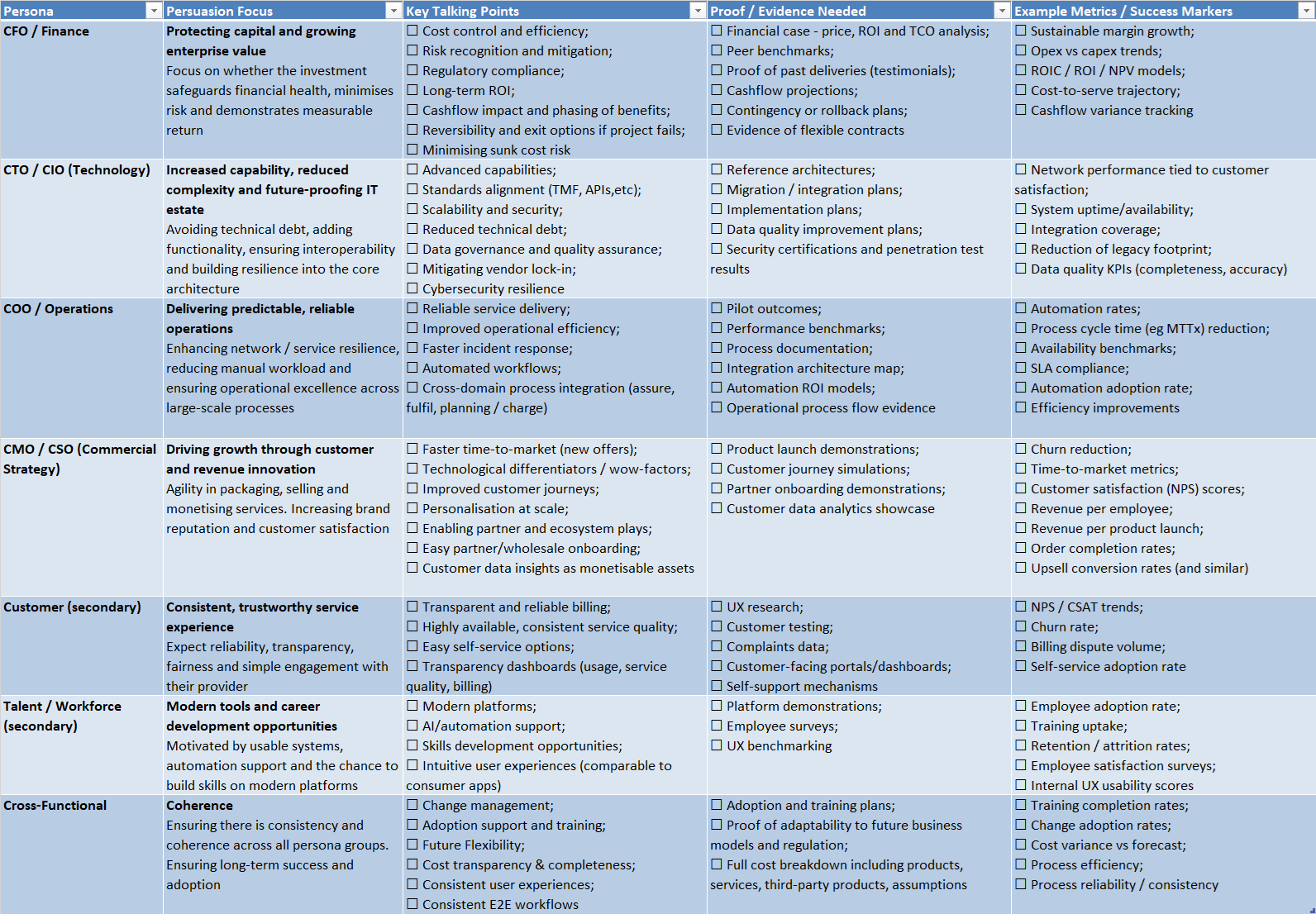

As mentioned, there are usually many stakeholders that are impacted by an OSS/BSS transformation (the charts above only show some of the generic, high-level group functions). Therefore, there are many stakeholders set to benefit from an improved OSS/BSS suite. It’s rarely a question of whether a benefit will be achieved (via the technical solution), but who will benefit the most, in which ways and for what level of resource investment.

The Mercedes Conundrum commonly kills or delays much needed OSS transformations. Some of the best salespeople that I’ve observed are the ones who can unite a telco’s silos more effectively than any of the telco’s own stakeholders. This is also why external consultants are often used by telcos, working as an objective outsider with no vested interests in factional conflicts.

The following cheat-sheet is designed to help minimise the impact of the Mercedes Conundrum, whether you’re presenting to the key stakeholders internally (as someone trying to get an OSS transformation project initiated) or externally (as a vendor bidding for the supply of a new OSS). The actual stakeholders, objectives and metrics will vary from project to project, but this provides a basis for preparing your own checklist to tick off whilst preparing an OSS transformation proposal.

The right-most column, “success markers,” is one that requires particular attention.

The highest-performing telcos define a single overarching objective, often framed in terms of sustainable value creation. Everything from network engineering to customer experience is expected to roll up into this “north-star” metric. According to STL Partners (thanks Amy), “Elisa has developed a culture and an approach to business that has seen it grow capital value, deliver dividends, keep customers happy, and attract and develop talent.”

This is in sharp contrast to the “Mercedes star” model where each business unit pulls in different directions. Elisa stresses that aligned telcos eliminate local optimisation and siloed metrics, replacing them with cascading KPIs that reinforce the top-level goal.

Aligned telcos translate the north-star into practice:

CFO view -> Return on invested capital, sustainable margin growth

Operations view -> Automation rates, process cycle time reduction

Commercial view -> Churn reduction, NPS stability, revenue per employee

Tech view -> Network performance metrics tied explicitly to customer satisfaction

The consistency lies in the way each unit’s KPI is directly linked to the productivity/value loop rather than standing alone.

As OSS/BSS practitioners, we often don’t have the remit to establish these top-level strategic KPIs. That’s the responsibility of executive leadership teams. However, the table above hopefully does show how our OSS/BSS can aggregate north star KPI roll-ups.

.

It takes a lot of effort to build a bridge across the Buyer-Seller Chasm and get an OSS transformation underway. It’s about the big-picture and the small details alike. Your methodology has to ensure that you’re not just building a business case, you’re building a coalition of support that ticks every stakeholder’s boxes.

Here are a few of the key factors to consider:

One Story, Many Lenses: The same transformation, told differently to each persona

No Orphans: Even though not every persona has equal decision power, every cell in the checklist/business model maps still need to be covered

Evidence Over Hype: This one is really challenging due to the lack of availability of benchmark data from past clients, but wherever possible, replace generic “innovation” claims with measurable outcomes and proof points

Risk Neutralisation: Assume the CFO/COO (or equivalent) personas will default to “no,” as will many of the people who are having change forced upon them. As such, show exactly why risk is reduced, not increased and keep the messaging as simple as possible

Portfolio Alignment: Like Elisa, position the project as protecting the yield model, reducing risk, providing flexibility and enabling selective growth

The aligned model is not just about KPIs, but also about operating model simplification, such as:

Reduced product catalogues and simplified offerings

Process automation embedded into operations, rather than bolt-ons

Shared objectives across commercial, operational, and technical units

After a major outage, we conduct PIRs (Post Incident Reviews). If we find something, we usually add controls. But when you think about it, that’s

When you’re planning your next-generation OSS/BSS roadmap, what’s guiding your decisions? Are you looking for and/or researching features that have never been seen before? Are

According to Russ Hill, IBM had 27 top priorities in the 1990s, and only 3 of them aligned. Telcos today aren’t far off. The cost?

You’re in the business of OSS sales (we’re all in the business of OSS sales if we want to work on an OSS project). Your