What to Build, What to Drop: A Product Roadmap Scorecard for OSS/BSS Tools that Endure (part 4)

Most OSS/BSS roadmaps today overflow with novelty and buzz. You might even hear the words Agentic AI come up (not that I have anything against

Telcos are built for resilience.

But when a critical exchange burned to the ground in regional Australia, it exposed the industry’s greatest weakness and its greatest strength are one and the same: the ability to adapt.

What happened to Warrnambool Exchange in 2012 wasn’t just a fire. It was a story that shattered the commonly held illusion that big telecom is unable to change. While an entire region scrambled to restore services, we saw just how fast telco could move when it was given no choice.

The Warrnambool Exchange in 2012 (AAP: Telstra)

.

Warrnambool isn’t the only burning platform in telecom. We want change. We need change but structurally we find it really difficult to consider significant change.

.

Large telcos are machines of stability, reliability and perhaps most importantly, predictability.

Their very structures, sprawling org charts, decades-old systems/processes, highly resilient networks, are all designed to maintain, not transform.

Resilience machines, yes. Reinvention machines, no.

Change is about embracing chaos but telcos are critical infrastructure, both for the communications services they deliver and the promises they make to their customers (remembering that a telco’s “real” customers are institutional investors who prioritise predictability in the form dividends first and growth as a bonus, so drastic change is disincentivised).

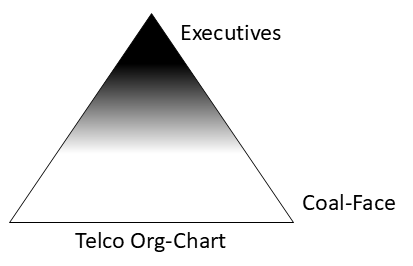

As mentioned in the recent “world-views” article, different parts of the org chart have different perspectives on the purpose a telco serves.

As we look at telco org charts, we see structural effects that curtail anything other than incremental change.

When first entering the telco industry, as a freshly minted Engineer at the bottom of the pyramid (see image below), I had aspirations of rising to the upper echelons of the org chart. However, I quickly noticed that the senior ranks possessed a different set of skills than most coal-face workers. Rather than prioritising the technical skills of the coal-face (whether Engineers, Accountants, Coordinators, Business Analysts, etc), the higher-ups had to become more adept at navigating bureaucracy, politics and manoeuvring advantages for the teams under their leadership. Any decision to take on disruptive change, risk and chaos just opens the door to positional weakness and career suicide,

Investors add another layer of friction. Tier-1 telcos are often favoured by institutional capital precisely because of their predictability. Dividends are expected. Growth is encouraged, but only if it comes with minimal volatility. Any effort that looks like risk gets quietly shelved. Any person proposing that risk is also likely to get shelved too.

This is not a bug in the system. It is the system.

The Lindy Effect is a theory that the longer something non-perishable has existed, the longer it is expected to continue existing.

Telcos are textbook Lindy organisations. Their longevity is treated as proof of reliability and their legacy systems / processes are wrapped in an aura of invincibility. But the Lindy Effect, once a badge of honour, has become a shield against necessary change. Stability is no longer a strength if it prevents survival (more on what Euro CEOs think of that later).

.

Here lies the paradox. Change is about embracing chaos. Yet everything about telcos are engineered to eliminate it.

As critical infrastructure providers, telcos are bound by regulations, uptime / SLAs and conservative governance. Any change that threatens service continuity is treated as an existential risk. Complex transformations are debated like open-heart surgery. New ways of working are viewed with suspicion because the default assumption is that change breaks things.

This caution is understandable. Networks underpin emergency services, defence, banking and commerce. The impact of the Warrnambool Exchange fire demonstrated just how critical a telco’s infrastructure is. However, caution has also become calcification.

Every time a disruptive idea is proposed as a way of getting off the burning platform, it’s met with a familiar chorus: “legal won’t allow it”, “what if regulators object?”, “investors won’t like the uncertainty”, “what if the project fails?” Even when change is proposed with clear benefits, the weight of institutional complexity tends to suffocate it.

Telcos are not just afraid of chaos. They are structurally incapable of choosing to embrace it, even when survival depends on it.

.

The telco industry is losing ground slowly but relentlessly. It’s not a case of the big eating the small, but the fast eating the slow. Value and share of wallet is shifting elsewhere – to hyperscalers, to digital-natives, to over-the-top players, to platform aggregators. CAPEX-heavy investments like access network footprints, coverage and spectrum are no longer moats. They’re table stakes.

Many executives acknowledge the burning platform in quiet, off-the-record conversations. At MWC, Orange’s CEO Christel Heydemann cited a survey of European telcos in which almost half of the polled chief execs said they do not expect their businesses to make it through another decade. That doesn’t sound too Lindy to me!!

Yet quarter after quarter, we only plan little changes. Strategic plans are full of euphemisms like “optimisation,” “synergy” and “incremental evolution.” But the core (red box below) remains unchanged and features are added around the edges (in the blue arrow to the right of the long-tail diagram below).

This is the real cost of indecision. It’s not dramatic. It’s not front-page news. It’s slow, cumulative erosion.

Here’s the hard truth. The pain of staying the same has long since flipped to be greater than the pain of change. But most of us still don’t acknowledge it.

So, what am I doing about it? It’s easy to talk a “big change” game, like so many others, but much harder to do anything about it.

The following are two playbooks where I’m actively seeking to demonstrate new precedents for the telco industry.

.

Private Equity (PE) players are increasingly interested in telcos. Not because they love the tech, but because they see operational inefficiencies hiding in plain sight (and the long-term, too critical to fail, protected revenue streams are attractive too). Unlike traditional investors, PE firms come with urgency. Their model doesn’t allow for long transformation timelines or incremental ROI.

When PE enters a telco, the rules change. There’s more openness to new models and disruption. Legacy can be scrutinised. Decisions can happen at speed. There is no emotional attachment to the old way. There are only the questions: does it help the business move faster and serve customers better?

Just between you and me, I’ve explored acquisition on a couple of smaller telcos. The aim is to find one to demonstrate, through action rather than words, how a new precedent can be created. One that proves a new model is not only possible, but profitable.

.

Smaller telcos don’t have the same inertia problem as the big players. With less mass, fewer dependencies and more direct accountability, they can change direction quickly (ie F = ma). They don’t need a two-year planning exercise before even starting to make any changes. They just do it within weeks.

Tier-2 operators build with agility, cross-train their teams and rethink their engagement with vendors. Their culture rewards pragmatism and experimentation over hierarchy and procrastination.

Here’s a summary table from “How budget and mindset shapes OSS procurement differently for T1 and T2 carriers“:

These are not hypothetical models. They are playing out in real-world operations today. While Tier-1s are stuck in steering committees and lengthy “three forevers” procurement cycles, Tier-2s are steering their futures in more pragmatic ways.

The irony is that the big players could adopt many of these ideas, if they were willing to watch, listen and learn from the smaller, faster, bolder players.

.

When was the last time you saw a Tier-1 telco publish a real case study about internal reinvention? Not a press release. Not a PR story. A genuine example of core operational change led from within. By choice!?

They’re rare to the point of them barely existing. Here are a couple of examples from Nokia and Telefonica.

Transformation theatre has replaced actual change. Budgets flow to top-tier consultants. Teams present plans. Roadmaps stretch across multiple years. Procurement events are initiated. But the culture, systems and ways of working remain largely untouched.

In these environments, OSS is treated as a cost to control, not a capability to unleash. Transformation is outsourced instead of owned. And most importantly, the coal-face workers with the ideas to solve their own problems are often not the ones with the authority to act on them.

.

All these same headwinds have existed for years. Then the exchange burned down and showed that change can occur quickly when choice is removed.

The Warrnambool incident was devastating. But it also triggered one of the fastest mobilisation efforts the Australian telco industry has seen. Services were restored in days. Engineers, field teams, suppliers, planners and coordinators were all working around the clock. No delays. No committee sign-offs. No procurement bottlenecks. Just action.

This was not magic. It was mobilisation. It was an urgency to fix what everyone knew was a big problem.

It showed that telco can move when it must. The talent, tools and coordination mechanisms are already there. They are just buried under the hum-drum of business as usual.

Why did it take a disaster to unlock that level of urgency? Why can’t we operate with that mindset every day (or at least in sprints)? What would Elon Musk do if he took over a telco (oh wait…)

Warrnambool is more than a story of rapid recovery. It is a story of potential. It shows what happens when an industry sheds its self-imposed constraints, even for just a moment, and does what it has always been capable of doing.

Having worked at start-up telcos, I’ve noticed a huge difference in energy, hope and urgency when the telco is in BuildCo mode… yet also observed the despondency and reduced motivation that occurs after the inevitable rounds of lay-offs when the telco shifts to RunCo mode.

As another example, I sometimes wonder whether the net neutrality argument is just about removal of choice – having someone else (ie regulators) make a decision to change (I’m over-simplifying of course).

.

Telco doesn’t need another strategy deck. It needs a new precedent.

The breakthrough we want is on the other side of discomfort.

When we’re unfit, like telco is now, we have to go through the discomfort of exercising to make us fitter, faster, stronger. Re-building stamina and muscle hurts.

We need leaders, at every level, who see discomfort not as something to avoid, but as the path to growth.

We need sponsors and suppliers who understand that OSS is a gateway to transforming entire business models.

The burning platform isn’t metaphorical. We’ve already seen what can happen when things go up in flames.

The big question is who will lead the way?

Leave us a comment with your “burning exchange” thoughts and stories.

Most OSS/BSS roadmaps today overflow with novelty and buzz. You might even hear the words Agentic AI come up (not that I have anything against

Modern telco software roadmaps tend to be full of novel features. But what if none of that novelty is enduring? What if the silhouette of

After a major outage, we conduct PIRs (Post Incident Reviews). If we find something, we usually add controls. But when you think about it, that’s

When you’re planning your next-generation OSS/BSS roadmap, what’s guiding your decisions? Are you looking for and/or researching features that have never been seen before? Are