Turn Incidents Into Resilience X-rays: Using Network Outages as Complexity Audits

After a major outage, we conduct PIRs (Post Incident Reviews). If we find something, we usually add controls. But when you think about it, that’s

If asked to think about telco’s most valuable assets, most people think spectrum, networks and customers.

But if we think a bit more laterally, telcos have other compounding growth engines that are never discussed, to the point of being invisible.

In fact, the assets that have the potential to compound fastest probably don’t even appear on a balance sheet.

The quote below was the seed idea behind today’s article.

“Play iterated games. All the returns in life come from compound interest – in money, in relationships, in knowledge.”

Naval Ravikant (as compiled in The Almanack of Naval Ravikant by Eric Jorgenson)

So, what are the compounding effects at the disposal of the telco industry?

Telcos and their OSS/BSS environments are uniquely placed to unlock the “iteration effects” that follow. By playing the long game, telcos can take overlooked resources and transform them into competitive advantages that grow stronger over time.

Let’s explore five such assets and how OSS/BSS play a central role in bringing their compounding value to life.

.

This one is hardly invisible. In fact it’s almost a trope. But it still hasn’t been unlocked by the telco industry for the most part. We won’t go into the customer data side of this coin, partly because it’s already widely discussed, and partly because telcos are so highly regulated that there are strong headwinds to overcome.

However, that still doesn’t rule out the potential of a telco’s data to deliver great returns.

Most telcos are sitting on mountains of operational data, yet much of it is still treated as exhaust rather than fuel. What makes this data so powerful is not a single dataset, but the way it has the potential to improve every time it’s reused, refined and cross-linked.

Take network telemetry. The first iteration may only provide basic fault detection. But when OSS platforms enrich that same data with topology, performance and customer-impact context, it compounds into something far more valuable: predictive insights, proactive remediation and smarter investment decisions. Combined, it has the potential to be a finely tuned Control Tower for the entire business.

The same applies to automation frameworks. Every script, policy, or workflow built into OSS becomes more powerful the more it’s reused. A simple fulfilment script might save minutes per order today, but when embedded into an automation library and reused thousands of times, the return on investment multiplies. Multiply that by many automations and the benefits can be profound. I’ve even heard some people say that you can reach such a large coverage through rules-based automations that AI/ML are only needed to clean up the diminishing returns part of the automation benefits curve.

Layer on workforce learning loops and the effect accelerates. Engineers who repeatedly work with OSS/BSS data become better at spotting anomalies, identifying patterns, and applying automations that others may overlook. Their expertise compounds just like the data itself. That helps improve the automations, driving further improvements.

.

Trust doesn’t appear on any balance sheet, yet it’s one of the most valuable assets a telco owns (potentially). Customers don’t tend to leave because of price alone. They leave because their trust has been broken through billing errors, unreliable service, or poor support.

OSS and BSS play a quiet but critical role here. Every time a service is provisioned seamlessly, every time a bill is accurate, every time an outage is resolved quickly, every time a security breach is resolved quickly, trust capital grows. It may be invisible, but over years it becomes a formidable moat, particularly when there have been so many public breaches of trust by telcos in recent years.

Customer experience insights amplify this effect. By using OSS/BSS to capture and analyse every interaction, telcos can continuously refine experiences. Each successful improvement compounds into higher loyalty, stronger net promoter scores and ultimately, reduced churn.

Trust is not just about customers either. Long-term vendor and partner relationships, underpinned by fair negotiations, shared value outcomes, joint investment funds and transparent data sharing, create exponential returns in collaboration and innovation.

.

In fast-moving industries, data and the value of knowledge depreciates quickly. Yet in telecoms, certain kinds of knowledge actually appreciate with time. The longer teams work with OSS/BSS, the more valuable their accumulated knowledge becomes.

Tribal Knowledge and context: As a consultant, the longer I work with a client, the better I understand their “tribal knowledge” and the better my advice for their specific context.

Knowledge bases and runbooks: are another prime example. The first entry in a fault-resolution database may save a single engineer a few minutes. By the time hundreds of entries have been logged, and each has been refined through repeated use, the database becomes a compounding engine of efficiency.

Similarly, institutional learning within OSS teams builds resilience. When troubleshooting knowledge, architectural design insights and lessons from past projects are captured and shared, teams can solve problems faster and avoid repeating mistakes. This is particularly true for project business case review exercises. Each iteration of reviewing the outcomes after the project has been implemented makes the organisation sharper, more adaptive and more capable.

This is the OSS dividend: knowledge that pays out over and over again, growing in value every time it’s applied.

.

Most telcos dream of step-change transformation programmes, but many of the real long-term gains come from small, iterative improvements in process, system and integration maturity.

Take partner integrations. The first API integration between a telco and a partner might unlock a narrow function. Over time, as more APIs are built, standardised and reused, the telco’s ability to onboard partners quickly and scale services compounds. What was once a months-long process can shrink to days, creating building blocks that open the door to entirely new business models.

Iterative pain-point removal, as described in previous article, “Subtracting the Suck: An OSS Product Roadmap.”

Ecosystem goodwill emerges from these iterative improvements too. When OSS/BSS are designed to be transparent, reliable and collaborative, they make life easier for customers, back-office staff, partners and suppliers. Over years, this goodwill compounds into stronger ecosystems, faster time to market and mutual growth.

Each small OSS-driven process and/or friction improvement might seem minor in isolation. But add them together, iterate consistently, and the compounding impact can be extraordinary.

,

Last but certainly not least, is the un-tapped value currently locked up within the telco ecosystem. This is the factor that I feel holds the greatest potential of all. This most surprising iteration effect comes not from what telcos hold internally, but from the value they enable in others. OSS and BSS are the connective tissue that allows ecosystems to flourish.

This is partly described in “Why Telcos desperately need an 8th Layer in the OSI Model” where the uppermost layer of the OSI networking stack is currently absent. That is the business relationship network that delivers referrals and opportunities for the telco’s client-base.

By providing introductions, exposing APIs, sharing data responsibly and enabling third-party innovation, telcos can create exponential value for clients (ie. outside their own walls).

An ecosystem partner might build a new customer-facing service, leveraging the telco’s OSS/BSS infrastructure. Another might analyse network insights to create industry-specific solutions. Each partner contribution compounds back into the telco’s platform, increasing its relevance and reach. Another might provide an introduction to a value supply-chain partner. There are many ways the telco can add business value to their subscriber-base.

This is ecosystem value creation, a form of compounding that doesn’t show up in quarterly earnings but has the potential to eliminate churn and transform telcos into indispensable platforms over time.

.

The lesson from compound interest is simple: small, consistent iterations create extraordinary returns over time. The same principle applies in telecom.

While spectrum, networks and customers will always be valuable, the unexpected assets – data, trust, knowledge, processes and ecosystems – may ultimately generate the greatest long-term competitive advantages.

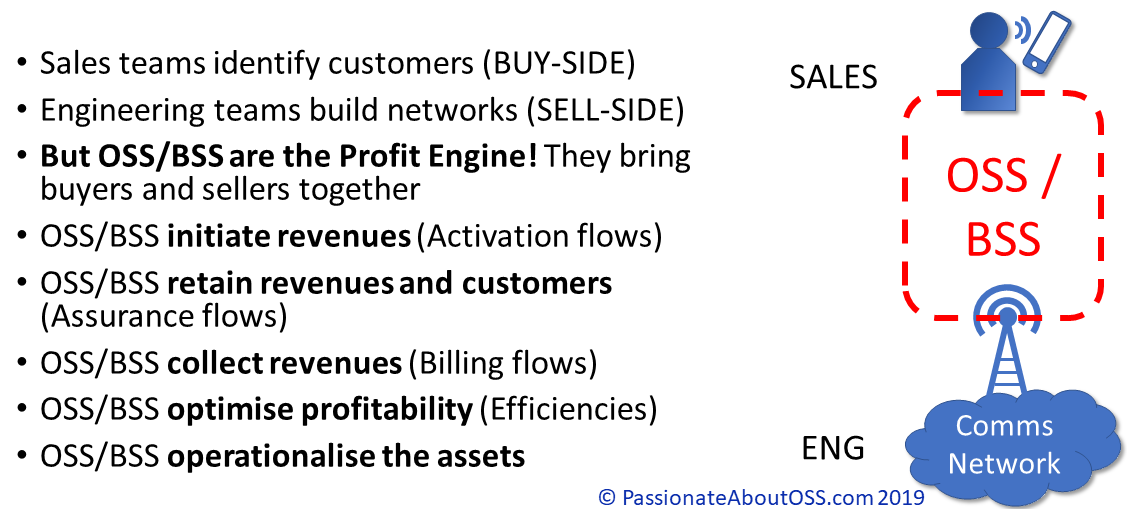

OSS and BSS are at the heart of this story. They are the mechanisms that allow iteration to occur, the platforms that capture learning, and the profit engines that amplify compounding effects.

The telcos that recognise and nurture these hidden assets are more likely to survive and thrive in a hyper-competitive market, quietly building an advantage that grows stronger with every iteration.

After a major outage, we conduct PIRs (Post Incident Reviews). If we find something, we usually add controls. But when you think about it, that’s

When you’re planning your next-generation OSS/BSS roadmap, what’s guiding your decisions? Are you looking for and/or researching features that have never been seen before? Are

According to Russ Hill, IBM had 27 top priorities in the 1990s, and only 3 of them aligned. Telcos today aren’t far off. The cost?

You’re in the business of OSS sales (we’re all in the business of OSS sales if we want to work on an OSS project). Your